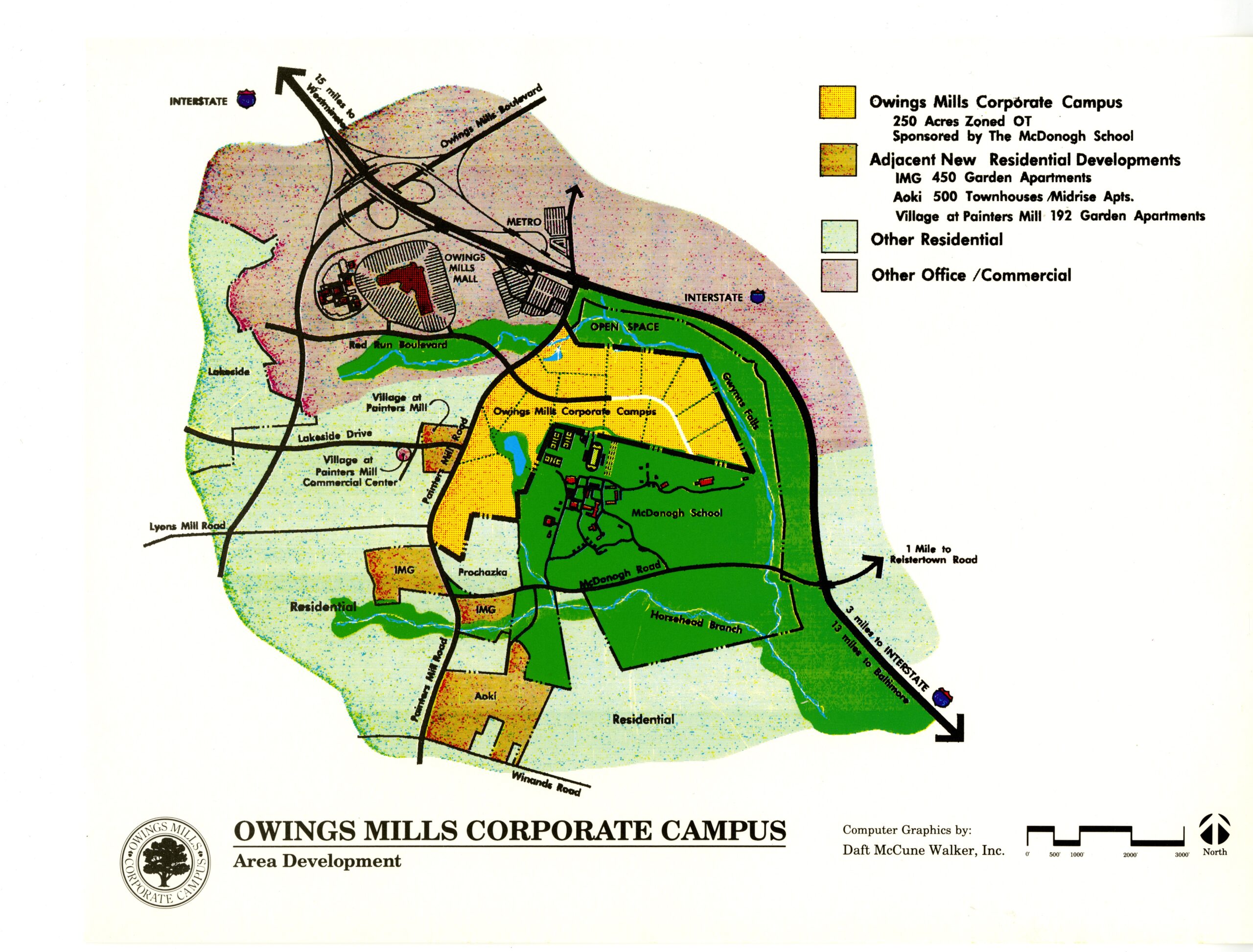

In 1977 as the Owings Mills area began to grow, the leadership of McDonogh School realized that they must take action to protect their interests in the rapidly growing area. The School’s unused land was threatened. McDonogh’s Board of Trustees submitted a plan to the county that would allow the School to use excess land for economic purposes. In doing so, the land would be less susceptible to county seizure and protected from encroaching development. The Board had determined that leasing the land rather than selling it would, in the long run, be more profitable. A Land Use Committee was formed, and over the next few years, they created an office park called the Corporate Campus. The plan was to give the School control over the type of tenants who would build in the Corporate Campus office park and eventually become profitable.

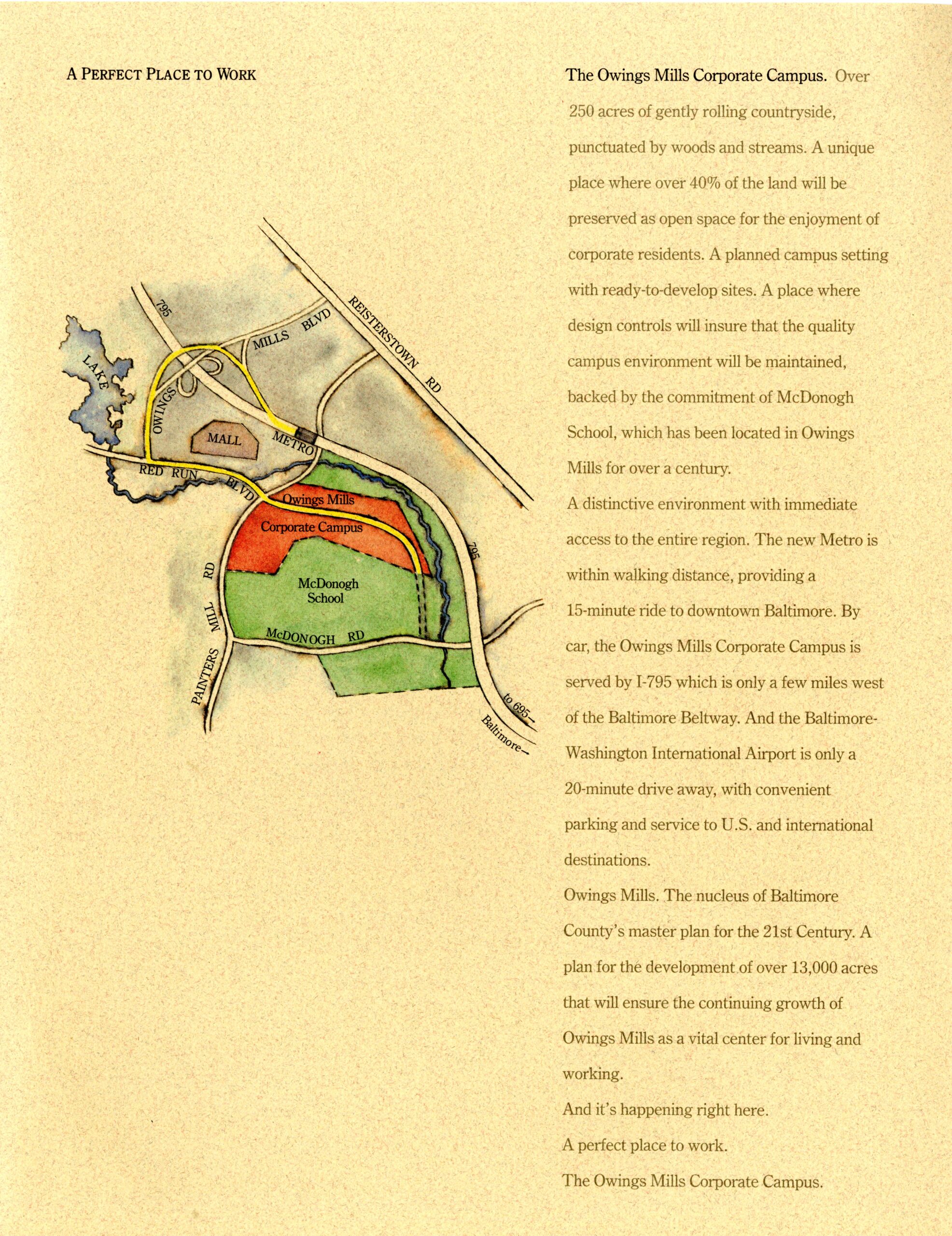

Of the more than 250 acres earmarked for the Corporate Campus, over 40% of the land was preserved as open space for the enjoyment of corporate residents. The Corporate Campus was marketed as a planned campus setting with ready-to-develop sites; a place where design controls would ensure that the quality campus environment was maintained. Four well-established local corporations (Manekin Corporation, Baltimore Life, Greater Baltimore Medical Center, and T. Rowe Price) opted in.

The Corporate Campus was considered a success, and in 1996, the School sold 32.5 acres to T. Rowe Price. An editorial in the March 1996 issue of The Week applauded the sale of land to T. Rowe Price and explained the history behind the Corporate Campus. It follows:

“Shrewd Land Sale” – The Week, March 1996

In December, McDonogh sold a 32.5-acre parcel of land to T. Rowe Price. The land is located on the southwest corner of the school’s property and will not be visible from the school’s campus. The Week feels that the sale of the land was a shrewd, aggressive move, with few drawbacks.

To begin with, the choice of T. Rowe Price is commendable. McDonogh has had a positive experience with T. Rowe Price on the Corporate Campus. T. Rowe Price has plans for a five-building complex that will be in the same style as many of McDonogh’s buildings, a choice it made without prodding from the school. Regarding the sale, Mr.

Dixon noted, “It’s a combination of a really respected neighbor being at the right place at the right time.”

The reason that now is the right time for the sale of the land is the harsh financial realities that McDonogh is facing. As a letter to the faculty and staff noted, “As recently as June of 1995, some 94% of McDonogh’s endowment income was restricted to specific uses.” Currently, a large majority of the endowment is restricted, with much of the money allocated for scholarship use, leaving little of the endowment for day-to-day operations. By selling the land, McDonogh can boost the total endowment, which will in turn boost the percentage of the unrestricted portion of the endowment.

This will allow the school to defray more of their expenses in everyday operations. It should also be noted that 20 of the acres in the sale were purchased previously for the express purpose of resale at a later date. The idea was that by buying the land, McDonogh could control its own borders, and sell the land to whomever it chose. There are, however, some possible drawbacks to the sale. One, the T. Rowe Price offices will eventually employ over 1,000 people. This will lead to an even greater volume of traffic on Painters Mill and McDonogh Roads. Mr. Dixon said that he doesn’t believe the sale will renew calls for a road through the campus. He also went so far as to say that if the

trustees had believed that the land sale could result in the extension of Red Run Boulevard through the campus, they would have had serious misgivings. He added that the Price complex “may be a further catalyst” for having the county repave or even widen McDonogh Road.

A second possible drawback is the risk that the construction on the land could damage its fragile environment. This doesn’t seem likely, however, because McDonogh has historically been very environmentally sensitive. In fact, the Corporate Campus was originally going to be larger, but plans were scaled back because of environmental concerns.

The land sale has enough positives to far outweigh the possible negatives. The trustees should be commended for their original decision to buy the land surrounding their borders as well as for the land sale to T. Rowe Price.